We would like to invite you on a journey. You’ve been building your company for many years, and it is now the right time to take it to the next level. However, in order to build a highly scalable company that generates industry-leading profitability and solid cash flow, you need a world-class finance function.

Now, finance is an interesting animal! It’s both highly complex and also super simple. What if I told you that there is a recipe that you can start following today to build the engine room of your business, the machine that generates the growth, profitability, and free cash flow that you dreamed of when you started the company? Read on for a few minutes as we unpack this for you.

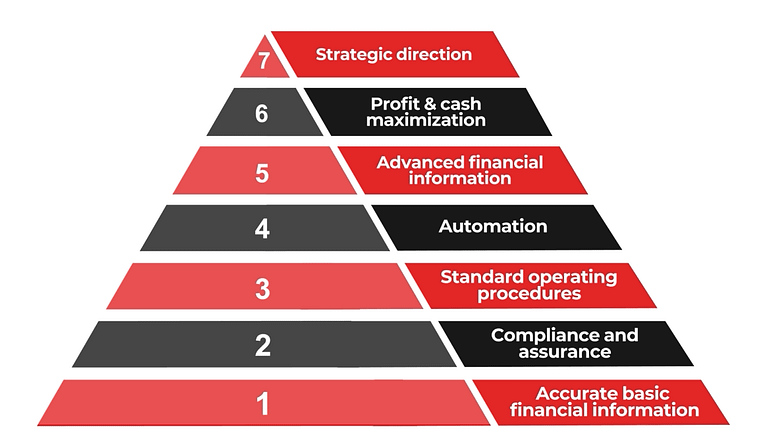

Just like humans have a hierarchy of needs, there is also the finance function of a scale-up company. Imagine a pyramid where you have your basic needs such as survival at the bottom, and at the top, you have your more advanced needs. Now, what will this look like for a scale-up company?

- Accurate Basic Financial Information

At the base of the pyramid, you have the need for accurate, basic financial information. What we mean by this is basic income, basic expenses, basic assets, and basic liabilities. You want to be informed at all times about the income, expenses and profitability of the company, as well as the assets, liability, and net equity value of the business. To ensure that, the first thing you have to put in place is that foundation of simple financial information, to be informed about income and expenses, debtors and creditors, as well as your balance sheet, that will give you insight into cash in and cash out on a monthly basis. This is always the base and the starting point for any company.

- Compliance and Assurance

On top of basic financial information, you must have compliance and assurance. In this instance, you want ensure that your affairs are in order in terms of the tax man. You want to have companies tax, VAT, payroll tax, annual financial statements, and any other legislative requirements in place for the company. Once you have all that in place, the founders can sleep well at night.

- Standard Operating Procedures

The third, layer is standard operating procedures (SOPs). You want to ensure that there is an SOP for every core function within the finance of the company. You also want to ensure that there are SOPs for invoicing. How does it work? Who loads what? Who ensures that invoices are sentto clients, et cetera. The same applies to debtor management. How will your company deal with the debtor management process, creditors management, the payments function in the company, which is so critical, the month-end closes for the finance team, and all of those other core finance functions within the company. You want to ensure that the procedure is simple to follow and easy to execute and that nothing can slip through the cracks.

Great, so now you have the first three bases in place, and this really forms the heart of a good accounting function. You have good basic financial information coming through – income, expenses, assets, and liabilities. You have good compliance to support that so that your affairs are in order with the taxman. You also have good standard operating procedures that govern how you run things to ensure that nothing falls through the cracks. The next thing you are able to do is automation.

- Automation

The fourth layer in our pyramid is called automation. It basically means to streamline systems and procedures, to integrate the flow of information, and to minimise room for human error within those processes. This can be achieved with a really good cloud tech stack. You want to take a hard look at your finance and operations functions and what technology will suit the business best to ensure that all of those processes can be automated and streamlined, and made as simple as possible to replicate. This starts creating scale.

- Advanced Financial Information

The next layer is the need for advanced financial information. This is where we really want to get granular with the detail in terms of moving the company forward and really understanding it, first of all. This relates to detailed gross profit margin analysis, detailed net profit margin analysis, understanding your profit per client and your profit per the smallest economic unit that you can trace. The detection of any profit leakage in that process to ensure that you can plug that. You understand how effective your people are in terms of your labour efficiency ratio. You will be able to accurately forecast cash flow over the next couple of months or the year ahead to identify any issues. You also want to delve into key ratios and do some benchmarking on that, and really start doing advanced reporting for the business as per the requirements of the board and the management team.

- Profit and Cash Maximization

Now it starts getting exciting. We move on to profit and cash maximisation. Once you have your advanced financial information on the table, you can move onto setting gross profit and net profit targets across the business. You can also start implementing tools like the power of one and other profit and cash maximisation tools, to really ensure that you move all the levers you have at your disposal, to move the company forward. You will start looking at pricing strategies and other approaches to ensure that the company is absolutely maximized.

- Strategic Direction

Right at the top of the pyramid we find the strategic direction. You want finance to actually inform the strategy of the company. What kind of clients are the best ones to target? What business units or product lines are the ones that you should double down on, or which ones should you cut? When and who should you hire, as well as when and who not? When and where should you invest and where not? Basically, how do you create and maximise the value of this company for a potential exit or for the shareholders themselves, to ensure that this company keeps driving maximum value as it grows and scales into the future.

In Summary

Building a world-class finance function for your company is a journey indeed. Perhaps you are just at the beginning of yours, and you want to lay a strong base for the future. Perhaps your basis has been strong for many years, but finance is not yet directing the strategy of your company and driving the free cash flow and profitability that you deserve. Wherever you are, our team of finance professionals have seen it all, from early-stage scale-up companies to multi-hundred million exits. How much could it be worth to you to have access to a team of finance professionals who have been down this road with hundreds of companies before? Start your journey towards industry-leading profitability today. Find out more at ocfo.com, or reach us at info@ocfo.com. We are excited about the adventure that awaits!

TAKE THE TEST – GET YOUR PERSONAL FINANCIAL HEALTH SCORE FOR YOUR BUSINESS FOR FREE!

Want to know how you stack up and how to further improve your company’s financial engine? Our free Financial Health Tool assesses your company’s finances in accordance with the Hierarchy of Financial Needs. Get your Financial Health Score today!