OVERVIEW

Clear financial reporting. Best in class accounting technology. Peace of mind.

An annual independent review of your financial statements can assist in ensuring that your company is compliant with various regulatory requirements. Reviewed financial statements also give your stakeholders and third parties, like your bank, a peace of mind that your financial statements are free from material misstatements.

WHAT’S INCLUDED

Get access to great bookkeeping and accounting professionals

What is an independent review?

An Independent Review is a limited assurance engagement, where the practitioner performing the engagement only gives limited assurance as to the accuracy of the financial statements.

When looking to review financial statements, the objective is to enable a practitioner to state whether anything has come to the practitioner’s attention that causes the practitioner to believe that the financial statements are not prepared, in all material respects, in accordance with the applicable financial reporting framework (negative assurance). This statement is made on the basis of procedures which do not provide all the evidence that would be required in audit reviews.

A review engagement is preferred when the company’s financial statements have already been prepared and the company engages an external accountant or practitioner to review the financial statements. Since the financial statements are also signed off by directors, the external practitioner is required to provide negative assurance that the reviewed financials are free of material misstatements.

During the review, the practitioner performs analytical procedures to gain a better understanding of the figures. A review engagement is less intensive than an audit in terms of the procedures performed by the practitioner. Therefore, the practitioner cannot express an opinion on the fairness of the financial statements, they can only state that the financial statements are free from material misstatement.

Who is involved in an Independent Review?

- Management is responsible for preparing the financial statements, either internally or independently by an accountant. Management is also responsible for the implementation of internal controls to assist in the preparation of financial statements that are free from material misstatement. A financial statement review checklist is often used in this process.

- The practitioner receives these financial statements, and is then required to perform minimum procedures with respect to the information received, to enable a limited conclusion on whether the financial statements are fairly presented.

- The practitioner will then conclude on the review engagement.

How does an Independent Review work?

A review engagement consists of two phases. First, through inquiry and analytical procedures, a practitioner gathers a limited amount of evidence on whether a client’s financial statements are free of material misstatements.

Secondly, based on the limited evidence, the practitioner expresses a limited (or negative) assurance on the financial statements in the following form:

Based on our review, nothing has come to our attention that causes us to believe that these financial statements do not present fairly, in all material respects, the financial position of ZYX Company as at February 28, 20XX, and (of) its financial performance and cash flows for the year then ended, in accordance with International Financial Reporting Standards for Small and Medium-sized Entities.

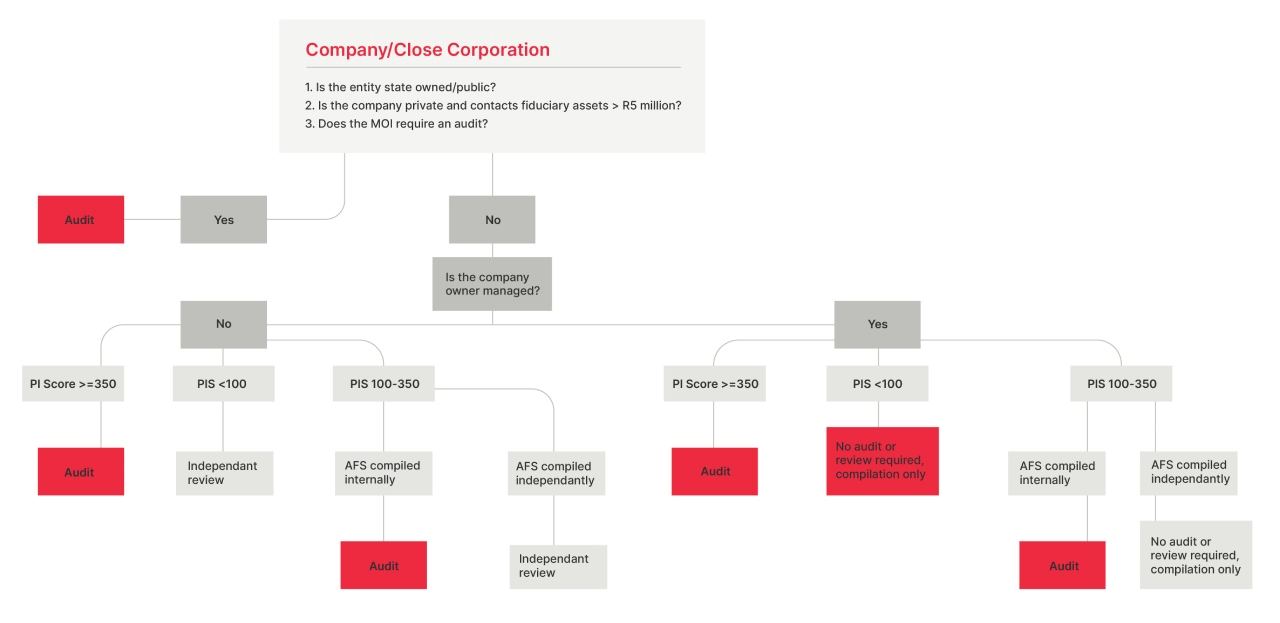

Which entities need to be Independently Reviewed?

Independent Reviews have to be completed for entities that meet the following criteria:

- PI Score of 100 - 350 where the Annual Financial Statements are compiled independently, the company is not owner managed, not state owned or public, does not hold assets more than R5 Million in fiduciary capacity and where the MOI does not require an audit.

- PI Score of less than 100, where the company is not owner managed, not state owned or public, does not hold assets more than R5 Million in fiduciary capacity and where the MOI does not require an audit.

Where companies are owner managed, independent reviews are not required, since the owners of the company are also managing the company. For these companies, Independent Reviews can be performed voluntarily if the PI Score is less than 350 and the financial statements are compiled independently, or where the PI score is less than 100. An independent review can also be performed voluntarily for CC’s but the cost versus benefit needs to be considered.

What is my PI Score?

The Public Interest Score (PI Score) indicates the degree of public interest in your company. A company’s PI Score is calculated with the help of a point system. Various financial parameters are given points that are added to find the overall PI score of the company. These include:

Number of Employees

The first parameter used in calculating the PI Score is the number of employees in a company. However, if this number varies every year, the average number of employees is taken into consideration. After arriving at the average number of employees in the company, one point is allotted per employee.

Third-Party Liabilities

At the financial year-end, the total amount of third-party liabilities are calculated. After which, one point is assigned for every R1 million (or portion thereof) in third-party liabilities of the company.

Turnover

The total turnover of a company is the next parameter for calculating the total PI Score. One point is allotted for every R1 million (or portion thereof) in a company’s total turnover during the financial year.

Number of Stakeholders

At the end of the financial year, companies calculate the total number of stakeholders in their companies. For a profit company, these can be the individuals who have a direct or indirect beneficial interest in the company’s issued securities. On the other hand, for a non-profit company, these individuals can be members of the company. One point is assigned per individual having a beneficial interest in the company.

Please see the flowchart below to determine if your company needs to be independently reviewed:

We can calculate your Public Interest Score, advise as to whether a financial statement compilation, independent review or audit is required and perform the independent review on your annual financial statements and relieve you from your concerns over assurance of your financial statements and accordingly allow you to focus on growing your business and preparing for the next big fundraise.

TESTIMONIALS

What Our Clients Say.

Entrepreneurs change the world. They create growth, job opportunities and social impact. We serve entrepreneurs! Hundreds of founders and management teams tap into the expertise of their trusted finance and accounting partner to help scale their companies.

Business is about people. When you partner with Outsourced CFO, a finance professional or team with the right mix of knowledge, skills and experience is personally matched with your company – working with you to create a world class finance function for your growing company. Your success story is our success story.

PARTNERS

Our Clients.

RESOURCES

Read Our Latest Insights.

Ultimate Guide to Cloud Accounting

Business functionality is moving online, and so should you. According to a survey from LogicMonitor, “87% of global IT decision-makers agree the pandemic will cause

4 ways to automate a business using Cloud Accounting

Four ways to automate a business using Cloud Accounting and avoid the frustration of remote working. Every business owner is looking for ways to be

Scaling Up Into The Cloud

Scaling Up Into The Cloud – Seven Reasons Why Your Business Should Run on Cloud Accounting Software Automation and digitisation are major trends in scaling

FAQ

Frequently Asked Questions

How to review a financial statement?

Financial statements are reviewed by performing analytical procedures on the amounts in the financial statements and inquiring with management based on the submitted information.

When must an auditor perform a financial statement review?

Financial statements should be reviewed once the compilation of financial statements are done. According to the companies act, a company’s financial statements should be compiled six months after the end of the financial year. The review of financial statements should thus be done within six months after the financial year-end.

What is the difference between a normal financial statement review and an independent financial review?

A normal financial statement review does not have a report with any assurance on it. These reviews are normally done by management to see if the cosmetics of the financial statements are sufficient. An independent review needs to be done by a qualified practitioner and this review gives negative assurance on the financial statements.

Why independently review financial statements?

An independent review on financial statements gives management and users of the financial statements some assurance that financial statements are accurate and free from material misstatement.

GET IN TOUCH

Cloud Accounting

Please fill in your details below and one of our consultants will be in touch within the next 24 hours.

Services Lead Enquiry Form

"*" indicates required fields