In today’s fast-paced and largely online business landscape, effective financial management is crucial for sustainable business growth and success. Xero Accounting software offers a number of business-specific features and tools designed to simplify accounting processes, streamline and automate repetitive tasks, and provide valuable insights into your business’s financial health.

Whether you’re a small business owner, a freelance professional, or an aspiring entrepreneur, this guide will equip you with the knowledge and practical tips needed to navigate the intricacies of Xero Accounting software with ease. We’ll walk you through the key features and add-ons that will allow you to harness the true power of Xero for all your financial management needs. Along with the team of financial experts at Outsourced CFO, Xero Accounting software packages offer all the tools and expertise that you will need on your financial journey to success.

Understanding the importance of efficient financial processes

Every business owner dreams of this – smooth sailing through financial waters, where transactions flow seamlessly, numbers add up perfectly, and reports are a breeze. That’s the magic of Xero. By implementing Xero software for your financial function, you can minimize unforced errors, reduce administrative burdens on staff, improve your cash flow management, and gain a comprehensive overview of your financial health. Because when your financial processes run like a well-oiled machine, you can concentrate on what you do best – growing your business and leading from the front.

Introducing Xero Accounting and its benefits

Xero Accounting is a game-changing software system designed to revolutionize the way businesses manage their finances. One of the key benefits of Xero is its accessibility. Being cloud-based, it allows users to access their financial data anytime, anywhere, and from any device with an internet connection. This ensures that you and your team can stay connected and collaborate seamlessly, whether in the office, on the go, or working remotely.

Xero also provides users with a centralized platform for managing income and expenses, generating professional invoices, tracking cash flow, and reconciling bank transactions effortlessly. With automated bank feeds, bank reconciliation becomes a breeze, saving valuable time and reducing the risk of errors.

Through customizable dashboards and detailed reports, users can monitor key performance indicators at a glance, identify trends, and make smart, data-driven decisions. Xero also simplifies the process of managing and paying bills – often low on the daily to-do list. Staff are able to easily capture and store receipts digitally, schedule payments, and automate any recurring transactions.

No software can stand alone these days, and Xero is no exception. Xero integrates with a wide range of third-party applications, including payment gateways, payroll systems, inventory management tools, and customer relationship management (CRM) software. This means that you can create a tailored software ecosystem that meets your unique needs, eliminating data silos, and enhancing overall process efficiency.

How OCFO enhances financial management with Xero

At Outsourced CFO, we understand the challenges that come with the old processes of manual bookkeeping and complex Excel spreadsheets. Using Xero’s powerful cloud-based platform, we empower businesses to streamline their financial processes, track expenses, and generate real-time reports effortlessly in the following ways:

Automated Bookkeeping: OCFO leverages Xero’s myriad automation capabilities to simplify bookkeeping tasks. Bank feeds automatically import transactions, eliminating errors and saving you valuable time.

Real-Time Reporting: Access to real-time financial insights is crucial for effective decision-making and keeping your financial department in the know. Xero’s robust reporting features, combined with OCFO’s input and expertise, provide you with clear and comprehensive reports. Instantly track your cash flow, monitor key performance indicators, and analyze financial trends. With a deeper understanding of your financial position, you and your team can make strategic decisions that drive long-term growth.

Streamlined Expense Management: Managing expenses can be a hassle, especially as your business grows. OCFO and Xero simplify expense tracking and management by making the most of Xero’s built-in automation capabilities. Capture receipts on the go with Xero’s mobile app, automatically categorize expenses, and reconcile them with bank transactions seamlessly. It always pays to know where the cash goes.

Collaboration and Security: OCFO and Xero enable seamless, online-enabled collaboration between you and your financial team. Share access with your outsourced accountant or bookkeeper, allowing them to work directly within the platform, while you keep control. Collaborate in real-time, share financial reports, and ensure everyone is on the same page. Rest assured, Xero’s state-of-the-art security measures protect your sensitive financial data.

With OCFO advisors at your side, and using Xero, you can streamline your financial processes, save time, and gain valuable insights into your business’s financial health to the benefit of your bottom line.

Table of Contents

Getting Started with Xero Accounting

Although the accounting function is vital for business success, the detail of capturing and logging all entries can be time-consuming, pulling employees away from more vital work. At the same time, small businesses don’t always have the funds to hire an accountant or CFO full-time. This is where cloud-based and automated accounting software packages like Xero shine, allowing small business owners big-firm functionality and ease at a fraction of the cost. In the past few years, and especially during pandemic-forced remote work, online functionality has boomed, and more and more companies are adopting online and cloud-based functionality and software like Xero.

Setting up your Xero account:

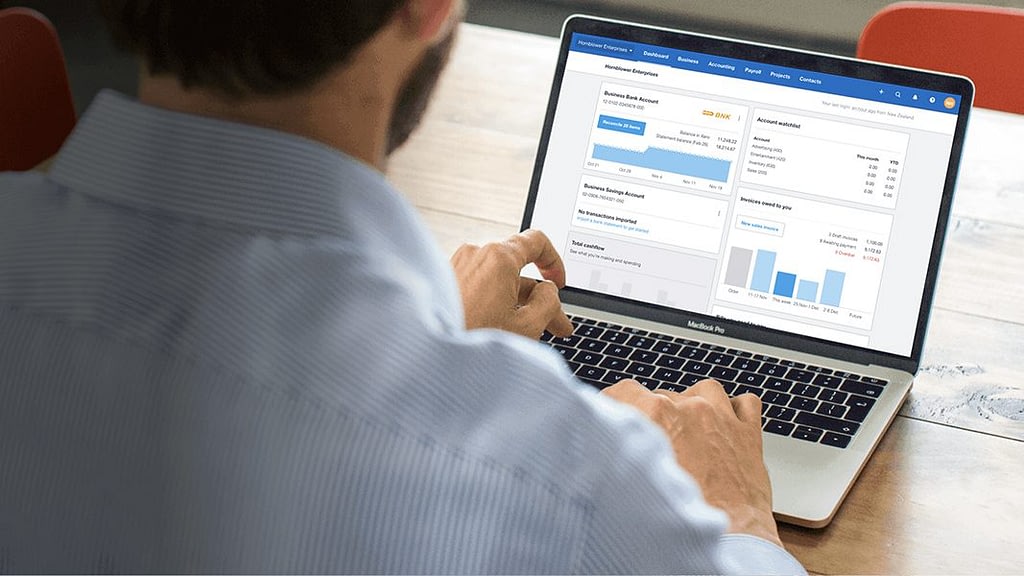

- Navigating the Xero dashboard

The dashboard of your Xero organization contains setup panels for important features such as bank accounts, online invoices, bills and more. - Customizing your settings and preferences

The Xero dashboard displays when you start using Xero. Once you’ve set up items like bank feeds and invoices, your dashboard charts and graphs will show that information, allowing you to adjust what items are displayed so that you can keep track of metrics that add value. See how to set up and adjust your dashboard

Xero software allows for a number of plug-and-play features that are tailored to address many accounting pain points experienced by SMEs in their growth phase.

Commonly used business tools that can be integrated with Xero:

- Payment Gateways: PayPal, Stripe, Square, Payfast and Ozow.

- CRM Systems: Salesforce, HubSpot.

- E-commerce Platforms: Shopify, WooCommerce, BigCommerce.

- Expense Management Tools: Expensify, Dext, ApprovalMax.

- Time Tracking Software: Toggl, Harvest.

- Inventory Management Systems: DEAR Inventory, Unleased.

- Reporting and Business Intelligence: Microsoft Power BI, Tableau, SyftAnalytics, Spotlightreporting

The choice of integration depends on your specific business needs and processes, so make sure to get expert advice from your OCFO partner about integrations.

Chart of Accounts and General Ledger

The chart of accounts is a list of all accounts you can use to record your transactions in Xero. It helps you categorize your transactions correctly and group similar accounts together to generate reports as you need them.

Xero assigns a default chart of accounts when you set up your organization. If you prefer, you can import a chart of accounts from your previous accounting system, or import your own custom chart.

To view your chart of accounts, in the Accounting menu, select Advanced, then click Chart of Accounts.

Establishing Bank Feeds

Connecting your bank accounts to Xero

Should your bank allow it, you can connect your bank to Xero in order to automatically import transactions. Once you’ve connected your online bank to Xero, your transactions will automatically import into Xero each business day. You also don’t need to manually refresh the bank feed for your transactions to import, making this process a no-brainer.

Bank reconciliation

Xero software offers suggestions for reconciling your bank account, a feature that simplifies and accelerates the process of matching and reconciling bank transactions with your financial records. Xero imports your bank transactions directly from your bank account, then compares these transactions with the corresponding entries in your Chart of Accounts, making intelligent suggestions based on criteria like amounts, dates, and reference numbers – allowing you to accept suggestions, or allocate transactions yoursef.

Streamlining the process of recording transactions

Transactions flow directly into Xero each business day if you have connected to your online banking feed. This process allows you to:

- Set up feeds from multiple banks

- Get feeds from any number of bank accounts

- Import up to 12 months of historical data when you connect

- Daily bank feeds let you reconcile daily so the accounts provide an accurate up-to-date picture of your business finances.

- View a summary of the money coming in and going out on the dashboard

- Categorize transactions each day so a backlog doesn’t pile up

With daily bank feeds available you can reconcile your bank transactions regularly so you know where your business stands. You then have the option to categorize each transaction in Xero or simply confirm what Xero suggests.

Seamless Xero Accounting Integration with Business Systems

Integrating diverse functionality into one easy-to-use business system like those offered by Xero integrations is crucial to any operation that wants to stay ahead of the curve in today’s digital world.

Integration with CRM and Sales Systems

By connecting Xero with your CRM and sales platforms, you can effortlessly sync customer information, sales data, and invoices so that your sales team has real-time visibility into customer accounts, enabling them to make informed decisions and provide better customer service.

Integration with Project Management Tools

Xero offers streamlined Project Management Tools for smaller businesses, allowing you and your team to easily track project-related expenses, allocate budgets, and generate accurate financial reports.

Integration with E-commerce Platforms

In today’s digital-first era, e-commerce has become a significant revenue stream for many businesses. Xero’s integration with e-commerce platforms empowers you to manage your online sales and finances from a single platform by automatically importing sales data, tracking inventory, and reconciling payments.

Ensuring Data Security and Confidentiality with Xero Accounting

As a small business owner, you might be concerned about a cloud service provider storing your sensitive financial data online. But rest assured – the cloud is one of the most secure ways to store information. Xero has also been geared towards cloud-based functionality from the start, and security comes standard.

Robust Data Protection Measures

Cloud-based accounting packages like Xero address traditional safety concerns around sensitive financial data with higher, uniform security standards, automatic redundancies for data and scheduled, seamless security upgrades. Cloud accounting software packages offer better protection than small businesses would normally employ to protect their information. Cloud accounting, for instance, leaves no trace of financial data on company computers, and access to that data in the cloud is encrypted and password-protected and can be tracked and monitored in detail.

Confidentiality and Privacy Policies

Sharing data is also less problematic and error-prone with Xero. When using Xero, two users simply need access rights to the same system using their unique passwords in order to work together. If you also need to share financial information with an accountant or possible investor, you can easily grant access temporarily.

Xero software is also committed to ensuring compliance with the General Data Protection Regulation (GDPR), which is a comprehensive data protection law enacted by the European Union (EU). GDPR sets strict guidelines for the collection, storage, processing, and transfer of personal data of EU citizens. As a cloud-based accounting software provider, Xero recognizes the significance of protecting user data and has implemented robust measures to adhere to GDPR requirements.

Mitigating Fraud and Unauthorized Activities

Fraud and unauthorized activities can be disastrous for the cash flow of any business, and can also cause reputational damage. With Xero software you can rest assured that the following measures are in place to protect your interests:

- Proactive fraud detection: Xero uses advanced algorithms and machine learning techniques to detect suspicious financial activities. These automatically flag unusual transactions like duplicate invoices or unexpected changes in payment details, allowing you to take immediate action.

- Segregation of duties and access controls: Xero’s user permissions and access controls enable you to establish segregation of duties, meaning that different employees have access to different parts of your accounting system based on their roles and responsibilities. Xero also keeps a detailed log of user activity, enabling you to track and identify any unauthorized access or suspicious behavior.

- Regular monitoring and audit trails: Xero software provides comprehensive audit trails that document every financial transaction, modification, or access within your system. This allows you to trace activities back to specific users and flag any unauthorized actions or suspicious behaviour.

Xero software is set up to make fraudulent activities easy to track for SMEs. However, if you’re working with a financial professional, talk to them about the Xero Assurance Dashboard which allows you to view which users have accessed your organization and the areas they accessed.

Streamlining Financial Operations with Xero Accounting

Efficient financial operations are essential for the success and growth of any business. Manual processes can be time-consuming, error-prone, and hinder productivity. However, with the powerful built-in features offered by Xero Accounting, owners and their finance team can streamline their financial operations and achieve greater efficiency. After all – time is money.

Invoicing and Billing

Creating professional invoices with Xero templates

Xero Accounting provides a range of customizable templates for creating professional invoices that match your brand identity and include essential details such as your logo, payment terms, and contact information.

Managing payment terms and reminders

Xero allows you to set payment terms and reminders for your invoices, so that customers are aware of their payment due dates, reducing the chances of late payments. Automated reminders can be sent to clients – a proven way to speed up payment, ensuring a positive cash flow in the long run.

Automating recurring invoices

For businesses that have regular recurring invoices, Xero Accounting offers the option to automate the invoicing process. Once set up, recurring invoices can be generated automatically at predefined intervals, saving time and effort and freeing up your staff. This automation feature is particularly beneficial for businesses with subscription-based models or recurring service contracts.

Expense Management

Tracking business expenses and receipts

Xero Accounting simplifies expense tracking by providing built-in tools to record and categorize business expenses. Your team can now easily capture receipts by scanning or uploading them to the platform, eliminating the need for manual record-keeping. No more lost receipts! With all expenses logged in one place, your finance team has a better snapshot and control over spending, allowing more accurate budgeting and cash flow projections.

Utilizing Xero’s expense claim features

Team members can submit their expense claims directly through the platform, attaching relevant receipts where necessary. Managers can review and approve the claims digitally, streamlining the approval process and reducing paperwork. This feature ensures transparency, and timely reimbursement of expenses while cutting down on the possibility of human error.

Streamlining expense reimbursement processes

Xero allows you to link your expense claims with specific projects or clients, to ensure more accurate cost allocation. Xero also integrates with a number of popular payment platforms, allowing you to reimburse expenses directly to your staff bank accounts, making life easier for everyone.

Collaborative Financial Decision-Making with Xero Accounting

Traditional financial management processes often involve fragmented information and siloed decision-making, hindering the ability to respond quickly and strategically. However, by combining the power of Xero Accounting with the expertise of our consultants at Outsourced CFO, you can stay ahead of the curve and address issues as they arise.

Xero Accounting software is the central hub for all your financial data, providing real-time visibility into your company’s financial health by integrating various financial sources such as bank accounts, payment gateways, and expense management systems into one dashboard. No more manual data consolidation that drains hours – a financial snapshot is available at a glance. Benefits include:

- Data Analysis and Reporting: With customizable reports and key financial metrics at your fingertips, you and your finance team can assess revenue streams, monitor expenses, and track profitability.

- Strategic Financial Planning: Xero offers you crucial financial data that allows you to identify trends, forecast future performance and plan accordingly. By leveraging your access to real-time financial information with the strategic insights of your OCFO consultant, you have the opportunity to make the right financial moves to ensure success.

- Budgeting and Cash Flow Management: Xero’s integrated features simplify budgeting and cash flow management. Along with your financial team, you can set realistic financial goals and monitor budget adherence, allowing you to optimize your cash flow. It’s all about money in the bank.

- Risk Assessment and Management: Using Xero’s financial data and reporting features such as bank reconciliations and real-time financial tracking means that you can identify trends and spot risks in real time. This enhances your risk management efforts so that financial decisions consider potential vulnerabilities and align with your company’s risk appetite.

- Scenario Planning and Forecasting: With Xero you can conduct scenario planning and forecasting exercises with ease. By simulating various scenarios, you can assess the potential impact of different strategies, allowing for agile decision-making that gives you the freedom to adapt and make the most of any investment opportunities.

By combining the high-level financial and strategic insights of your OCFO consultant with Xero’s myriad easy-to-use features, you are setting your business up for financial success.

Collaborative Financial Decision-Making with Xero Accounting

In the quest for financial control, businesses rely on advanced tools and technologies – like Xero – to streamline their operations and gain insights into their financial performance. Xero Accounting offers a range of easy-to-use and integrated advanced features that enhance financial control and decision-making.

Inventory Management

Inventory Management: Effective inventory management is essential for businesses that deal with physical products and manufacturing. Xero Accounting provides effective inventory management features enabling businesses to track, control, and optimize inventory levels. Key features include:

- Inventory Tracking: With Xero you can track your inventory in real time. It provides visibility into stock levels, allowingyou to make informed decisions about reordering, preventing stockouts, and optimizing inventory holding costs by matching supply with demand.

- Cost of Goods Sold (COGS): Xero’s COGS tracking feature allows you to calculate the true cost of goods sold. By accurately accounting for direct costs related to the production or purchase of goods, you can now accurately analyze profitability and make informed pricing decisions.

- Inventory Reporting: With Xero’s comprehensive inventory reports, you can analyze stock turnover, identify slow-moving or obsolete items, and optimize stock management and procurement for better overal efficiency.

Reporting and Analytics

When it comes to managing your business finances effectively, having access to accurate and insightful information is crucial. Xero Accounting software not only simplifies your financial tasks but also offers robust reporting and analytics capabilities.

Generating Financial Reports

Xero provides a wide range of pre-built financial reports that are essential for monitoring the financial health of your business. With just a few clicks, you can generate reports such as profit and loss statements, balance sheets, cash flow statements, and more. These reports offer a clear overview of your financial position, enabling you to track income, expenses, and cash flow trends. Xero’s user-friendly interface and customizable report templates make it easy to tailor reports according to your specific needs and preferences.

Analyzing Key Performance Indicators (KPIs)

Beyond standard financial reports, Xero enables you to delve deeper into your business performance by analyzing KPIs. Xero’s reporting functionality allows you to create custom reports that focus on specific metrics relevant to your industry or business goals. By monitoring KPIs like revenue growth, customer acquisition costs, or gross profit margins, you gain valuable insights into the strengths and weaknesses of your business. These analytics help you to drill down to areas that require improvement and drive strategic actions for growth.

Utilizing Xero’s Reporting Features for Strategic Decision-Making

Xero’s features extend beyond data visualization and analysis and can be a powerful tool for strategic decision-making. By leveraging the comprehensive financial data available, you can gain a holistic view of your business performance, allowing you to identify trends, spot potential opportunities, and address issues proactively. Whether it’s evaluating the success of marketing campaigns, assessing the profitability of different product lines, or analyzing the impact of cost-saving measures, Xero’s reports are your key to success.

Integrations and Add-Ons

Xero has a number of add-ons to help optimize your accounting procedures and ensure time-saving within your business. These plug-ins range from inventory to payment, payroll, conversion, CRM, time tracking, invoicing, and more. To look at the full list of plug-ins, visit the Xero App marketplace.

- CRM Integration: Integrating Xero with Customer Relationship Management (CRM) software syncs customer data, invoices, and payment information. This ensures seamless data flow and improves customer relationship management.

- Payment Gateways: Xero integrates with popular payment gateways, allowing you to receive payments directly through the software. This integration simplifies the payment process, improves cash flow, and reduces manual data entry.

- Industry-Specific Add-Ons: Xero offers a marketplace of industry-specific add-ons that extends functionality for businesses in various sectors. These add-ons enableany business to address specific needs such as project management, inventory optimization, or e-commerce integration, further enhancing financial oversight.

There is a whole world of ad-ons that can make your use of cloud accounting software more powerful. Spending the time to incorporate these will be an investment that saves massive amounts of time and effort in the future.

More detailed steps for Xero integrations can be found here.

Partnering with OCFO for Optimal Financial Management

Keeping on top of your financial function is crucial for any business – but the stakes are even higher for startups and SMEs who have little room for error. Ironically, SMEs often do not have the resources to hire the financial expert that they so desperately need on a permanent basis. OCFO provides the solution. A part-time CFO or accountant available as needed, and can assist with expert financial advice, without becoming a permanent drain on the payroll.

Leveraging OCFO's Expertise in Xero Accounting

OCFO’s team of professionals has in-depth expertise and experience in utilizing Xero Accounting software to automate, streamline and structure your financial processes to your benefit. OCFO’s Xero Certified Advisors are experts at using Xero’s advanced features and functionalities and will go beyond basic bookkeeping to offer proactive financial strategy development.

The Benefits of Outsourcing Financial Management to OCFO

Managing financial operations is a critical aspect of running any successful business. However, SMEs face the dual problem of lacking in-house depth of expertise, while also not being able to afford a permanent staffing solution. Outsourcing crucial financial tasks to an expert from Outsourced CFO will offer you the following benefits, without placing a burden on your payroll:

- Cost Savings: Hiring a full-time, in-house CFO is expensive. An outsourced CFO gives you access to high-level financial expertise at a fraction of the cost of a full-time hire. Now you can access the skills of a CFO as and when you need it.

- Strategic Financial Guidance: A fractional CFO brings a wealth of financial knowledge and strategic expertise to the table, as they have probably worked with a number of clients from diverse fields. All the insight that they have gained from past clients can be utilized for you.

- Core Competencies: For SMEs, dedicating time and scarce staff resources to financial management can be a significant distraction from core business operations. By trusting your financial management to an outsourced CFO, you and your staff can lean into your areas of expertise, which will only benefit your business in the long run. In this way, everyone does what they do best.

- Scalability and Flexibility: Businesses grow, shrink and evolve over time, and you need your financial experts to adapt with you. Whether it’s supporting expansion plans, restructuring finances, or managing through challenging times, our advisors can tailor their expertise to meet your specific business requirements. As your CFO works part-time, you can also scale back hours to suit your budget and requirements.

- Leveraging technology: By outsourcing financial management to OCFO, you gain access to cutting-edge financial software platforms like Xero, along with the experts who can make the most of its features and capabilities.

- Risk Mitigation and Compliance: Non-compliance with financial regulations can damage your reputation and relationships with both vendors and clients. The experts at OCFO possess in-depth knowledge of regulatory requirements and will implement robust internal controls and perform risk assessments to ensure that your business stays compliant and up to date where it counts.

From cost savings and strategic financial guidance to scalability, access to cutting-edge functionality and risk mitigation, your on-call OCFO experts are here to make your life easier.

Final Thoughts on Streamlining Financial Processes with Xero Accounting and OCFO

Running your own company means you have a lot on your plate. That’s why you should work smarter – not harder. Streamline and automate your financial processes using Xero Accounting’s many built-in features, with a dedicated financial expert from OCFO at your side to guide you.

Xero Accounting offers advanced features such as invoicing and billing, expense management, payroll and employee management, inventory management, reporting and analytics, and integrations and add-ons – the list goes on. This allows you to automate tasks, gain real-time insights, track expenses, manage inventory, generate comprehensive reports, and integrate with other critical systems.

Also partnering with an on-call financial expert from OCFO means that you have access to strategic financial guidance using expert tools, all tailored to your specific situation – as and when you need it. By taking the financial function off your hands without adding to your overheads, our experts will allow you to focus on core competencies within your business.

The combination of Xero Accounting and a financial expert from the OCFO team creates a powerful synergy, enabling you to streamline your financial processes and make informed decisions that drive growth. Set yourself up for success with Xero Accounting and OCFO – your financial dream team. More here.