The OCFO Entrepreneurial Economic Update for 2020:

2020 is out of the blocks, bringing with it the potential and optimism that only the start of a new decade can. But entrepreneurs are not silo’s – even though they are agile enough to navigate rough waters, broader economic conditions ultimately filter through. In this economic update, we’ve put together some of the facts as well as some of the opinions of our CFO team, aiming to give business owners a realistic glimpse of the local economic circumstances that may influence their business in the year ahead.

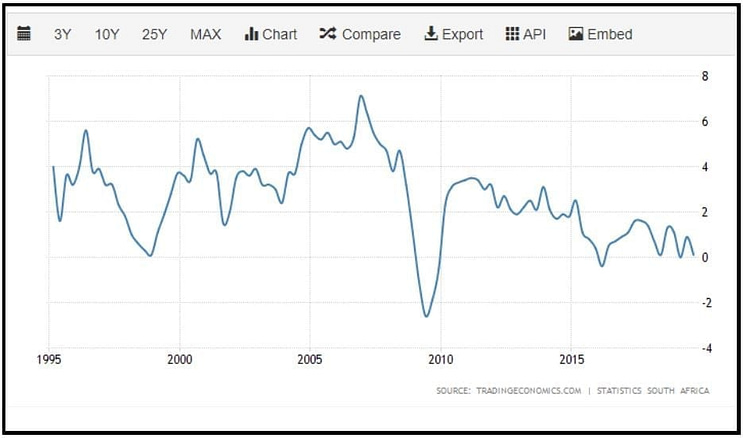

‘When assessing a country’s economic health, it is always good to look at Gross Domestic Product (GDP) as it is the sum of the market values, or prices, of all final goods and services produced in an economy during a period of time’, says Calvin Craig CA(SA). ‘As can be seen on the graph above, which summarizes South Africa’s GDP growth over the past 25 years, it is clear that our economic growth has been slowing down. A slow economy inevitably leads to fewer job opportunities and less foreign investment.’

Less than a month into 2020, South African companies have already announced thousands of job cuts. In a country where a third of the labour force is already unemployed, this will put even more strain on demand and economic growth.

Almost 6 000 jobs are at risk as companies including Telkom, the country’s largest fixed-line operator, and Walmart’s local unit Massmart plan to reduce their headcount after slumps in earnings. That’s after Sibanye Gold cut positions at its Marikana operations as part of restructuring plans and Glencore issued a notice of possible reductions at its Rustenburg ferrochrome smelter.

If realised, these job losses will add to an unemployment rate that is the highest in at least 11 years, and place a further damper on demand and consumption spending in an economy stuck in the longest downward cycle since World War II. Growth in household expenditure, which makes up 60% of economic activity, slowed to 0.2% in the third quarter despite a reduction in the benchmark interest rate.

An economic blueprint that President Cyril Ramaphosa co-authored a decade ago aims to reduce joblessness to as little as 6% by 2030, but the government’s actions are not helping. In addition to a lack of urgency in implementing policies that’ll boost growth and convince businesses to invest and expand, the state and its companies are also reducing workers.

Finance Minister Tito Mboweni has made it clear the state wage bill has to be trimmed, and that means a government that employs fewer people. Despite opposition from labour unions, the restructuring of power utility Eskom, which has billions of dollars of debt and a bloated workforce, will lead to job cuts when it eventually happens. The national carrier, South African Airways, is in bankruptcy protection and started cancelling flights to save cash, a step that could usher in a reduction in staff.

South Africa’s economy hasn’t expanded by more than 2% a year since 2013 and neither the central bank nor the National Treasury see it reaching that level by 2022.

The 2019 fiscal year was challenged by a number of unforeseen challenges, which has led to the economy missing the year’s market expectation growth of only 0.4%. Here are some of the challenges SA’s economy endured during the 2019 period, according to Gerrit Steenkamp CA(SA):

- Drought over large areas of the country, which leads to increased imports.

- Loadshedding (estimated that load-shedding alone, wiped 50% of our 2019 estimated GDP, at a total monetary value of 4 billion rands)

- Business insecurity regarding mainly 3 big topics (National health insurance, expropriation without compensation of land, nationalisation of the Reserve bank)

- The uncertainty of being downgraded to junk status, which will put even more pressure on businesses and consumers.

Needless to say, these factors had a great influence on the lack of business confidence in South Africa, which in turn led to our big firms setting up shop overseas, foreigners withdrawing their investments in SA and locals moving a majority of their savings abroad.

Looking forward, however, these harsh business conditions could be seen as school fees for the entrepreneurs who have managed to survive. The only solution, to fix GDP growth, is to create jobs and investment opportunities. And who better to invest in, than the jockeys that run companies who have shown that they can survive in the harshest of conditions.

We all know the saying – the bigger the risk, the bigger the reward. It may very well work out that the very people who manage to build great companies in this challenging economy might become those to whom future foreign investments, business opportunities and government incentives are entrusted in order to create jobs and stabilise our current trajectory.

Have you thought of automating your financial systems? Get in touch with our Systems Integration team today!